What is an insurtech? Insurance broker technology by Smarty

Insurtech is the combination of 2 words, “insurance” and “technology,” putting a label on the evolving and innovative technology that’s available to insurance brokers and agents. The evolution of insurtech inspires more efficient and robust processes, which include enhanced data analysis, Internet of Things (IoT), AI and machine learning, process automation, Big Data collection, drone analysis, and more.

Smarty offers several insurtech solutions for insurance carrier and insurtech business models, including rooftop accurate geocoding (the pin lands directly on the roof of the structure on a parcel), reverse geocoding solutions (to assist in looking where an address used to be before natural disasters wiped away markers like street signs), and property risk data (highlighting how historical risk related to weather patterns and natural disasters affects a property. Try them out for free, or keep reading to learn the answer to the question, “What is insurtech?” and more.

Before we get started, here’s a map that you can use to track where we’re going while learning about insurtech technology for brokers:

- What is an insurtech?

- The importance of insurance technology in the evolving insurance industry

- Modern insurance core platform requirements

- Trends in insurtech

- Insurtech impacts several insurance areas

- Smarty's impact with “Big Data” for insurtech

- Future-proofing your geocoding

- Wrapping it all together

- Strategic planning considerations

- FAQs

- Why is insurtech important for insurance companies?

- How does insurtech improve policy processing?

- How can insurtech streamline the claims process?

- How does insurtech help with customer service?

- How does insurtech build customer relationships?

- What is considered insurtech?

- What is the difference between insurance and insurtech?

- Who uses insurtech?

What is an insurtech?

An insurtech is a company that combines insurance processes (“insur”) and technology (“tech’) to provide the most innovative and efficient methods for working in the insurance industry.

Insurance technology comes in many shapes and sizes. There are raters, policy admin systems, risk modelers, claims managers, and many more. Some of these technologies' uses are table stakes for insurance companies, while others are insurtech platforms that give carriers, brokers, and agents a significant edge in streamlining their processes and improving their business models.

It’s automated tech at its finest.

The importance of insurance technology in the evolving insurance industry

Insurance used to be a paper-and-pen, on-premise industry. We can hear the manual grind now…

However, the evolution of the internet, the advent of AI, and the push for API-first platforms are the new driving forces taking over the insurance industry. Customers want seamless experiences that they can engage in over their mobile device, tablet, or laptop. Insurers want precise location data that’s enriched to the nines for a comprehensive picture of every address they might insure.

Where early systems focused on document storage and basic CRM functionality, the insurtech wave delivers AI-powered insights, predictive analytics, and automated workflows that still check allllll of the insurance compliance boxes and significantly reduce fraudulent claims.

It’s a big ask, but one that must be addressed; otherwise, your organization will fall even further behind than it likely already is.

So, what’s the problem with traditional risk management anyway? Why don’t we keep the “if it ain’t broke, don’t fix it?” mentality?

Frankly speaking, it’s “broke.”

Here’s why.

Traditional manual risk assessment limitations

Legacy systems in insurance are broken because they still rely on human-intensive workflows:

- Manual address entry and lookup

- Risk analysis based on ZIP Code or county

- Siloed data sources

- Reactive—not proactive—claims processing

These workflows limit scalability, increase the risk of errors and size of the losses you pay out on, as well as reduce competitiveness, not to mention the on-premise issues that arise from these processes:

- Higher operating costs: On-premise solutions cost you more in infrastructure and hardware. Electricity, cooling, server depreciation, and the physical building and storage space where it’s all kept aren’t cheap. It also comes with the price tag of occasionally over-provisioning hardware and paying for unused capacity during brief spikes or during periods of low traffic.

- Higher likelihood of maintenance: Paying top-dollar experts to chase down bad data isn’t a great long-term strategy, and it often leads to burnout and turnover for your teams. On-premise systems require a full-time IT team and specialized experts just to stay afloat. From performing regular security patches, vulnerability scans, and managing firewalls and encryption to maintaining data quality, redundancy, and uptime—it all adds up fast.

- Slower processing speeds: Manual reviews of documents, relying on in-person verification, tracking down missing subunits… it all adds up to slower workflows and even more money wasted on elongated processes. This equates to fewer customers being served, and it makes your current customers, who actually made the serviceability cut, incredibly frustrated with the delay in payouts for claims processing and the time-to-quote.

Wasted money and time??? In THIS economy?!?

It’s time for a change.

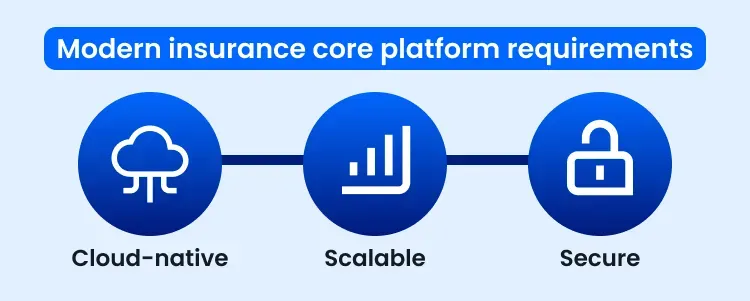

Modern insurance core platform requirements

Modern insurtech solutions integrate seamlessly with core platforms, enabling fast quoting, straightforward pricing, and real-time validation for claims. This evolution empowers insurers to compete on data accuracy, speed, and customer experience.

Let’s examine the highlights of moving your business from a reactive, slow, money pit to a proactive, tech-focused insurtech giant. To meet the demands of the modernized, mobile-centric world, insurance technology solutions must be:

- Cloud-native – enabling remote access and automated updates

- Scalable – supporting batch processing and real-time validation

- Secure – providing data encryption, audit trails, and compliance

Cloud-native

Utilizing modern insurtech platforms means that much of the process is done and stored in the cloud, rather than on-premises.

Cloud-native systems have lower operational overhead, allowing for more efficient and effective scaling as downtime is significantly reduced when implementing or adjusting the tools via a cloud space.

APIs and microservices improve flexibility for insurers looking to plug in best-in-class insurtech solutions because of the following:

- Plug-and-play capabilities (no rebuilding of core systems, here)

- Faster time to market (quoting, policy admin, and claims processing can be broken into modular components to roll out new features independently)

- Scalable performance (APIs are built to automatically scale on an individual level, so you don’t have to scale the whole application to provide more resources to one area or overspend on servers themselves to accommodate the one-off spikes)

- Resilience and fault tolerance (unlike a monolithic system, where one bug can crash the whole system),

- Customizable customer experiences (APIs allow frontend experiences to call the specific service they need on demand; finally, omnichannel delivery for web quotes, mobile FNOL, or chatbot claims)

- Easier-to-manage updates and maintenance (aka no more core system lockdowns; Update services independently, run faster, safer releases, and feel free to innovate without fear of disruption of core functionality)

- Better partner collaboration (how much easier is it to collaborate with MGAs, reinsurers, data analytics providers, and distributors who are all securely exchanging valid data in real-time? So much easier.)

Cloud security improvements

For those of you crying, “But isn’t the cloud unsafe?” it’s true that the cloud used to be somewhat wishy-washy in terms of security, but insurtechs have changed the way that we approach a cloud-native structure.

Now, cloud environments are subject to robust compliance frameworks, such as SOC2 and ISO 27001, as well as highly advanced threat and risk monitoring. Insurance broker technology is now often more secure than legacy on-prem systems.

Speed advantages

Insurtech makes everything so much faster. Critical for quoting, underwriting, claims, and the overall satisfaction of all stakeholders involved, fast data validation and geocoding at scale means that your decisions can be made in milliseconds instead of months, allowing you to care for more customers and put more money in your pockets instead of into damage control.

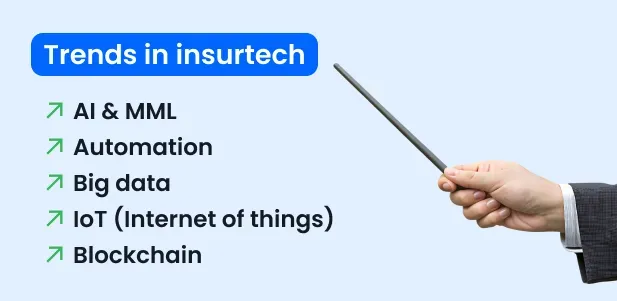

Trends in insurtech

The types of technological trends powering the insurance sector today are vast, especially thanks to the introduction of artificial intelligence and machine learning. Automated processes, Big Data, Blockchain, and the Internet of Things (IoT) are also shaking up insurance broker technology.

AI and MML

Machine learning models and AI have their shortcomings. (Pretty please don’t use AI to validate your addresses.)

BUT, this technology CAN be trained to flag suspicious claims due to synthetic-looking addresses or account creation. They can potentially compare address history, policyholder behavior, and repair estimates against previously determined benchmarks. They have the capability to analyze the IP address location in comparison to the address attempting to file a claim, while also pulling in time zone data and other property and personal data points.

While manually gathering and analyzing materials might take someone a VERY long time to compile, machine learning and AI can gather, compile, and synthesize all of that data in mere seconds.

Automation

FNOL can now be automated with chatbots and apps to capture the incident data instantly. Customers can upload photos through an app or “Report a Claim” links online. The system’s form (rather than a poor customer support rep) collects and can even validate all relevant data in real time as it’s being entered: policy number, location, time, type of loss, photos, weather reports, and even any available police data if applicable to the claim.

Not only that, but communication and updates that are tied to loss can also be streamlined. Customers can get automated updates and confirmations (rather than clogging up your customer service lines), track next steps, upload photos and receipts, and more directly into the insurer’s claims management system (CMS). This type of intense verification and tracking is automatic and automated in any good insurtech’s stack. FNOL is more streamlined than ever.

AND your legal teams will thank you for using an insurtech platform for FNOL processes because it’s more secure this way, too. Rather than having multiple people inside multiple accounts

Big Data

Big Data in insurance refers to the massive, diverse, and constantly growing sets of digital information that agencies and agents need to collect and analyze to do their job well. IBM breaks down the 5 V’s of Big Data in a way that would make V himself proud:

- Volume: There’s just so much stuff out there! Everything is digital, it seems, and most systems that aren’t are trying to become that way by endlessly scanning things into new digital portals.

- Velocity: Digital data flows in and out of systems almost instantly. Thanks to email, CRMs, texting, chats, and other digital tools, things move much more quickly in a Big Data-driven digital world.

- Variety: Structured (like text) and unstructured data (free-form text, videos, images) are part of big data. Instead of a form in a file cabinet that may only be referenced once, Big Data storage allows for a property to be assessed, images of the physical location can be taken, annotations on the images can be uploaded, estimates of damage and cost to repair can be sourced and attached, property risk evaluation can be conducted based on historical natural disaster tracking and distance to coast or fire zones, a video walk-through of the property can be attached… the sky is the limit with Big Data assistance in creating risk profiles and determining insurability on any property.

- Veracity: The accuracy and reliability of your data matter, and in insurance, you’re dealing with insane amounts of data coming from all over! You need to be able to rely on your insurance technology to be up to snuff to standardize, organize, validate, and enrich alllll of the data from allll of the different sources in a consistent and manageable way. That’s what an insurtech solution is for!

- Value: Optimized operations, perfected marketing, enhanced business strategizing, the list of added value to your business by employing an insurtech goes on and on.

Blockchain

Blockchain provides a single, tamper-proof source of truth that can be shared with all stakeholders concerning a transaction. Specifically in the insurance industry, this matters in terms of preventing fraud, improving claims processing transparency and efficiency, boosting risk assessment reliability, and meeting strict regulatory requirements.

- Fraud prevention: A shared ledger means that once a claim or policy event has been added to that ledger, it can’t be resubmitted elsewhere without being detected and flagged as potentially fraudulent. Additionally, all stakeholder credentials, from policyholders to vendors to adjusters, can be verified automatically through cryptographic proofs. (Think of cryptographic proofs as showing your ID without letting anyone read your name or address, just proving that you’re indeed over 21. It’s a mathematical guarantee between 2 parties without revealing unnecessary details.

- Claims management: As Big Data is a modern trend in insurtech, every step is recorded on a shared ledger, allowing every stakeholder to see real-time updates. Consequently, administrative overhead, reconciliation errors, and data silos are a thing of the past.

- Underwriting & risk assessment: Underwriters leverage blockchain-based data ecosystems to securely share, edit, and analyze data from multiple sources, including property records, sensor-tracked data (such as motion detectors, temperature, location, and moisture), historical claims data from other insurers, and more.

- Reinsurance & data sharing: Blockchain enables the real-time sharing of exposures, premiums, and losses, provides an avenue for automatic settlements once conditions are met by all stakeholders, and offers audit-ready transparency for all communications and transactions, simplifying regulatory reporting and compliance.

IoT

Instead of relying on annual reports or static paper records, insurtech platforms utilize IoT to enhance the quality, quantity, and timeliness of data entering and exiting their systems.

The Internet of Things (IoT) refers to a network of physical objects—”things”— that are embedded with sensors, software, and connected to one another to collect and exchange data securely online.

It provides insurance agents, brokers, and even reinsurance agencies with instant event detection, real-time verification, and predictive maintenance and prevention, continuity in risk profiling, precise data analytics to better assign pricing, error reduction and flagging, transparent audit trails, and improved customer experiences.

Insurtech impacts several insurance areas

As you can see, insurtechs give the insurance industry the eyes and ears in the real world that they need to improve processes across departments like claims management, underwriting, and contract execution in a way that will keep every legal and IT team happy.

Smarty's impact with “Big Data” for insurtech

Because there are so many things that are required for insurance processes to be smooth, accurate, and fraud-free, Big Data needs a big boost from organizations like Smarty, who empower you with insurtech-focused data analytics tools. Here’s how Smarty assists you in gaining clarity, confidence, and compliance in every link of the insurance value chain.

Rooftop-accurate geocodes at scale

Many insurtechs claim to have rooftop-accurate geocodes when really they’re relying on parcel centroid geocodes. These can often be rooftop-accurate, with the pin landing at the center of the structure located on the parcel of land, but there are many locations where that isn’t the case.

Think of a farmhouse that exists somewhere on a parcel stretching over acres of land.

What about condos, high-rises, business complexes, and apartments, where several valid addresses with secondary indicators all coexist in the same building? Don’t you want the pin to land on the center of apartment A, rather than the center of the entire building or parcel of land?

Of course you do!

Rooftop-accurate geocodes should MEAN rooftop accurate, even for those fringe cases where a parcel centroid geocode doesn’t cut it.

AND…

… you should be able to generate rooftop-accurate geocodes on a massive scale—not one at a time.

Smarty’s US Rooftop Geocoding API returns up to 55 points of metadata at speeds 10,000 times faster than our competitors, no matter the volume of data you push through.

Big Data enrichment APIs for deeper insights

Traditional insurers and even many modern insurtech solutions rely on fragmented third-party datasets stitched together from inconsistent sources.

One vendor might supply basic property attributes, another might cover flood or wildfire risk, and yet another might provide demographic overlays — all formatted differently, updated irregularly, and riddled with missing or mismatched addresses.

That patchwork approach makes risk modeling messy, underwriting incomplete, and portfolio visibility unreliable.

Smarty’s PUID, SmartyKey®, solves this by enriching every verified address with standardized, high-accuracy demographic data that’s tied to geocode and up to 55 points of metadata surrounding the address. Users can append and even pre-append their insurance data risk models to specific customer use cases and even have access to that data in perpetuity.

The best party? You can retain that data in perpetuity, even after your contract expires.

It’s Big Data enrichment that’s actually clean, complete, and cohesive.

Real-time portfolio visibility

Without real-time data visibility and precise geocode coordinates, portfolio managers can’t see accumulation risk, catastrophe exposure, or diversification investments with the accuracy required by regulatory frameworks or reinsurance agencies.

Smarty updates our data monthly, providing you with the best, most accurate, and most comprehensive data set for your portfolios and risk models.

With Smarty’s US and International Address Autocomplete, every form will populate a list containing only valid addresses for users to select from, automatically completing the form.

Competitive edge

For decades, insurance pricing has been based on territorial rating — crude ZIP Code boundaries that assume everyone in the same area carries the same level of risk.

However, in an era of precision data, that approach raises compliance questions and runs the risk of writing over- or under-insured policies.

Carriers that rely solely on ZIP+4 or centroid-level pricing models struggle to compete with tech-forward insurers, who use the primary structure to focus their underwriting. The result equates to overpricing safe customers, underpricing risky ones, and missing opportunities for more personalized products and services.

Smarty enables precision pricing models with US Rooftop Geocoding, and US Property Data that reflect true location intelligence. By grounding every policy in verified, rooftop-level data, insurers can differentiate on accuracy, fairness, and sophistication, not just coverage and cost.

Operational efficiency

Balancing multiple third-party vendors eats up time and efficiency. Legacy data analytics and cleaning processes eat up hours and multiply risk. Every time a human touches that data, the odds of an error or duplicate go up.

With Smarty, you can have all of your data points and enrichment surrounding an address in one place. Smarty might be the insurtech platform you need to streamline your processes and reduce vendor back-and-forth.

Regulatory confidence

Insurance regulation in the U.S. lives mostly at the state level. Each state’s Department of Insurance—led by an insurance commissioner—sets the rules for how carriers define territories, file rates, and use external data in underwriting. These departments enforce consumer protection laws and audit insurers through rate filings and market conduct exams to ensure pricing is fair, explainable, and free from geographic bias.

When filings rely on inconsistent or untraceable geocodes, even well-intentioned carriers risk regulatory scrutiny.

A territory boundary based on an outdated centroid or a mismatched ZIP Code can create the appearance of unfair discrimination, a red flag for any commissioner’s office.

Smarty delivers regulatory-grade confidence for insurers.

Every geocode, address, and metadata point is standardized, accurate, traceable, and fully auditable, allowing teams to show exactly how each location was verified and rated. 97% of Smarty’s US geocodes are available at the rooftop level of accuracy.

Not only that, but our documentation supports the reproducibility standards that states expect in filings and satisfies federal oversight from the Treasury’s Federal Insurance Office, which monitors systemic risk and data fairness across the industry.

Fair pricing. Transparent methods. Total confidence when compliance reviews hit your desk.

Future-proofing your geocoding

For insurance brokers, success often comes down to speed and precision during the quote-to-bind process. Every second counts—yet every data point must align with the carrier’s underwriting rules. Miss a detail, and you risk not only a rejected quote but also compliance issues, over- or under-insuring, and even a frustrated client who moves on to another broker.

Smarty’s cloud-native APIs make precise geocoding and address verification both instantaneous and reliable. Brokers can confirm exact property locations, verify eligibility, and pre-fill carrier-ready data directly into quoting platforms—without manual cleanup or follow-up corrections; it’s all automated.

Because Smarty’s insurance broker technology is built for scalability and transparency, it future-proofs your workflow as new regulations, data standards, and carrier integrations evolve. The products are constantly updated and refined as new rules and regulations develop, properties change, boundaries shift, streets are renamed, etc., and your business doesn’t have to keep track of those changes because Smarty does it for you!

Quoting a coastal property with storm surge exposure, confirming a commercial building’s rooftop coordinates, or validating risk zones for multiple carriers should be processes where you trust that your geocodes are accurate, standardized, and defensible.

As insurtech continues to evolve, staying ahead means keeping up with digital tools and mastering the data behind them.

Smarty gives you the speed to win deals, the precision to satisfy carriers, and the confidence to move from quote to bind without hesitation.

Emerging technologies

Here are some of the emerging technologies in insurtech platforms that you might want to consider:

Real-time risk monitoring applications: IoT and sensor-based technologies are now sending constant streams of data from connected homes, vehicle telematics, and industrial IoT networks to insurers, giving real-time exposure monitoring. Insurance industry giants can up their game with some real-time risk monitoring applications.

3D property modeling for enhanced assessment: Insurers are increasingly using drone imagery, LiDAR, and photogrammetry to create 3D digital twins of insured structures.

These detailed models reduce on-site inspections and provide objective records for pre- and post-loss comparisons. In areas with higher CAT risk, 3D property models support data-driven claims adjudication and more precise loss estimates.

With Smarty, you can power your 3D modeling, policy management, mapping, and any insurance processes with rooftop-accurate geocodes. If you’re evaluating an insurtech AI for your business, you want to ensure that the AI technology being used is trained on the best available data so that the decisions you make based on that data is also pinpoint accurate.

Climate change impact modeling: Climate risk models are only as good as the data that feeds them. The challenge is that the world they describe is no longer stable. Floodplains shift. Fire zones migrate. Hurricane corridors expand.

The traditional “100-year flood” model, which once guided underwriting decisions, is now an outdated promise of predictability.

In reality, risk zones evolve faster than the maps that define them. A property that was considered low-risk last renewal may now sit within an updated floodplain or wildfire boundary. Insurers who rely solely on static FEMA maps or legacy hazard datasets are left with blind spots that can expose entire portfolios.

Modern geospatial modeling changes that. By combining historical data with real-time environmental observations and predictive climate analytics, insurers can track how risk zones shift across landscapes in near real-time.

Machine learning and satellite-fed weather data make it possible to detect microclimate shifts and terrain vulnerabilities before they appear in public databases.

This dynamic approach replaces the fixed “lines on a map” mentality with evolving surfaces of probability that reflect how floods, droughts, and fires actually behave.

Smarty’s geocoding tools, address enrichment, and verification when combined with NOAA flood frequency data, USGS terrain models, and wildfire intensity scores, provide insurers with a dynamic model of risk rather than a static snapshot.

These models are especially powerful when paired with dynamic reinsurance planning and catastrophe modeling. By using standardized, auditable geocodes, insurers can align every risk zone and property exposure across internal systems and reinsurer models. This consistency reduces uncertainty in aggregate loss projections and strengthens confidence in regulatory filings.

Advanced insurance applications

There are plenty of advanced insurance applications in insurtech solutions:

Smart contracts with location-based triggers

Blockchain-enabled smart contracts can automatically process claims or adjust coverage when verified location data meets preset conditions. For example, faster claims resolutions are possible by adding a trigger to automatically payout following verification of a geocoded insured residence where the geocode falls in a disaster-affected area.

This clears up your backlog of requests and simultaneously builds customer trust and confidence—you pay out when you recognize the customer needs it instead of when they have a minute months later to file a claim.

Dynamic policy adjustment frameworks

When a floodplain shifts or a wildfire zone expands, accurate insurance coverage depends on systems that can adapt as quickly as the risks themselves. Dynamic policy adjustment refers to insurtech frameworks that automatically update policy data in response to changing environmental conditions.

A floodplain is only one layer of exposure.

True risk involves multiple interacting factors such as elevation, soil type, drainage, vegetation, and local development. These elements can change independently and alter a property’s vulnerability even if it remains outside of a mapped hazard zone.

Dynamic models integrate geospatial, hydrologic, and climate data to continuously reassess exposure. When rainfall patterns, wildfire intensity scores, or erosion data shift, policies can automatically update risk scores, pricing, or coverage limits when powered by an intuitive insurtech. This ensures that carriers and brokers always work with the most current information.

Smarty knows you are looking for continuous accuracy over the full policy lifecycle, fewer loss ratio surprises, and stronger regulatory compliance through transparent, data-driven updates.

Augmented reality for claims assessment

Using a mobile device, adjusters can overlay digital models to compare “before and after” states of a structure, measure damage remotely, and even estimate repair costs on-site. This reduces turnaround times and increases consistency across field and virtual assessments.

Smarty enhances this process by supplying the precise geospatial foundation that AR tools and insurtechs rely on.

Every AR overlay begins with an accurate coordinate system, and rooftop-level geocoding ensures that 3D models align perfectly with real-world structures and where they land on a parcel.

Without that precision, even a few feet of error can misrepresent a roofline, misjudge flood height, or distort the proximity to wildfire risk. Smarty eliminates those errors by verifying and standardizing the address, pairing them with pinpoint-accurate coordinates and property boundaries before a single model is rendered.

By combining US Property Data with risk datasets, insurers can take their analysis even further. Metadata, such as elevation, building use case (RDI), construction type, and proximity to hazards, provides context that AR systems can incorporate directly into on-site assessments, allowing adjusters to visualize not only where the damage occurred but also how environmental or structural factors contributed to it.

In short, augmented reality brings the visualization power; Smarty brings the spatial accuracy that makes it trustworthy. Together, they create a faster, verifiable, and more transparent claims process for insurers, reinsurers, and policyholders alike.

Wrapping it all together

Hopefully, we’ve fully answered your question, “What is an insurtech?” Even though technology and the insurance landscape have changed, the goal hasn’t. We’re still expecting and looking for accurate risk assessment, fair pricing, and exceptional service—but how you achieve it has evolved dramatically, and keeping up with that change by upgrading your legacy systems to insurance broker technology or insurtechs in general is the best way to be the business to beat.

Modern insurtech platforms connect every part of the insurance value chain through precision data, automation, and innovation. With tools like rooftop-accurate geocoding, property risk enrichment, and real-time validation, brokers and carriers can underwrite with greater confidence, reduce claims leakage, and maintain full regulatory compliance.

The result?

Faster decisions, fewer legal headaches, stronger margins, reduced loss ratios, and a brand that’s trusted for accuracy and transparency.

Smarty sits at the intersection of all these advancements, transforming raw address data into actionable insight that powers every modern insurance process:

| Insurtech focus area | What it enables | Smarty’s solution |

| Precise property data | Underwriting precision, portfolio management | US Rooftop Geocoding |

| Disaster readiness | Post-event validation, recovery planning | US Reverse Geocoding |

| Global expansion | Consistent location validation worldwide | International Geocoding |

Each of these tools empowers insurers to embrace the core promise of insurtech: to simplify complexity, strengthen accuracy, and protect what matters most. Don’t forget to look over our strategic planning considerations before diving in with any provider.

Strategic planning considerations

As you plan your next chapter in digital transformation, here are four strategies that’ll ensure your technology investments today keep delivering value tomorrow:

- Technology roadmap development: Build a clear plan that prioritizes integrations with cloud-native, API-first partners like Smarty to future-proof your data infrastructure. Consider the tech stack you want to implement. Do you need a policy admin system? Do you need a rater? What about a hazard risk provider or a new CRM? When all is said and done, don’t skip the essentials: rooftop-accurate geocodes, autocomplete, and address verification.

- Investment protection strategies: Opt for modular, interoperable systems that evolve with emerging data formats and regulatory standards. Additionally, consider utilizing AI-powered tools that can help determine the likelihood of an insured hiring an attorney to resolve a claim, scan for potential fraud, aid in customer service areas where human support may not be as necessary, or facilitate document management.

- Anticipating future data sources and formats: Prepare now for an ecosystem that includes IoT sensors, aerial imaging, and climate intelligence to strengthen underwriting and claims accuracy.

- Building internal geocoding expertise: Develop or partner for in-house expertise around rooftop-accurate geocoding and spatial enrichment to ensure precision at every step of the policy lifecycle. Smarty has clear documentation packed with sample code and SDKs in most modern programming languages. We’re also happy to support your learning curve with our extensive article library, video tutorials, webinar deep dives, and light-hearted blog series. Plus, we’ve built an API playground to excite any developer on your team who wants to play with the APIs in the sandbox before you set them in stone on your platforms.

FAQs

Why is insurtech important for insurance companies?

Insurance companies need partners who bring the same rigor, precision, and obsession with accuracy required to achieve near-perfect risk analysis and modeling. Insurtechs are built with that in mind and will focus on the accuracy of the data so you can focus on building better programs and driving a positive ROI. Let an insurtech handle the address data while you handle insurance. Go team!

How does insurtech improve policy processing?

Manual tasks can now become automated ones. Human error is reduced with insurance technology, which accelerates quote generation, ensures policies are accurately priced, and ultimately leads to faster processing and issuance of everything.

How can insurtech streamline the claims process?

This happens in 2 parts:

- Automation of previously manual processes in a digital space, where insurers can upload photos or details digitally, while insurance technology verifies the data being entered in real time.

- Incredibly accurate rooftop-level geocoding, which reduces fraud and increases confidence faster in policy accuracy

How does insurtech help with customer service?

Insurtech integrates chatbots, self-service portals, and automation tools that give customers 24/7 access to their policy information, claims status, and support. This assists your organization in reducing call volume and improving overall satisfaction while building trust and a positive brand reputation.

How does insurtech build customer relationships?

Insurtech provides a level of clarity and transparency that customers are looking for. We live in a world of instant gratification, and nothing breaks that happiness more than not being able to track where your claims or policies are in what can feel like an eternal pipeline of verifications and document scanning. Insurtech provides insight into the processes by making them visible, more efficient, and protected in a way that legacy insurance systems can’t.

What is considered insurtech?

Insurtech is a wide net that captures any technology that helps insurance agencies and reinsurance agencies to improve efficiency, transparency, compliance, accuracy, and customer satisfaction in their workflows. Examples of this might include AI, automated claims or processes, rooftop geocoding, or even blockchain-enabled smart contracts.

What is the difference between insurance and insurtech?

Insurance = the industry itself

Insurtech = innovative technology that empowers and enhances better risk management, processes, and services in the insurance industry.

Insurance is the greater umbrella where insurtech lives.

Who uses insurtech?

Many people in the insurance industry or insurance adjacent industries rely on insurtech, such as carriers, agents, brokers, reinsurers, MGAs, and all of their support channels or associated vendors.