New 42-day free trial Get it now

US Property Data

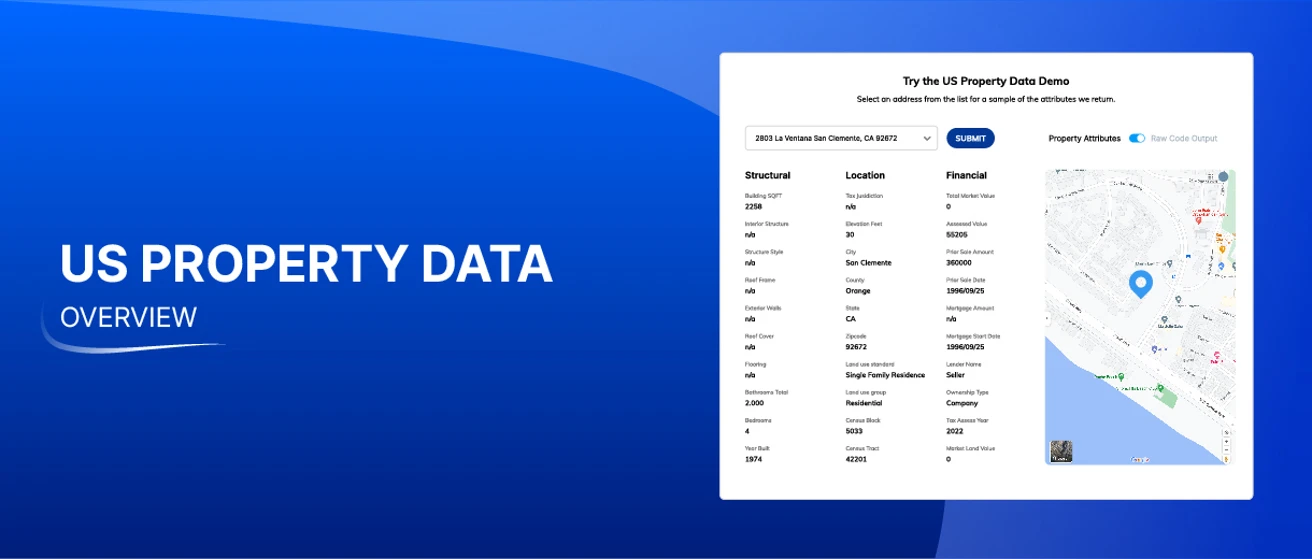

Get robust insights with 350+ property data points to build more accurate property data reports that inform investment decisions and risk analysis.

Try US Property Data live

Enhance risk assessment

By pairing Smarty's rooftop geocoding and magical property data API, you get a more precise property data USA solution to help make accurate risk assessments.

Improve investment decisions

350+ property data characteristics for an accurate investment assessment– whether commercial or residential property.

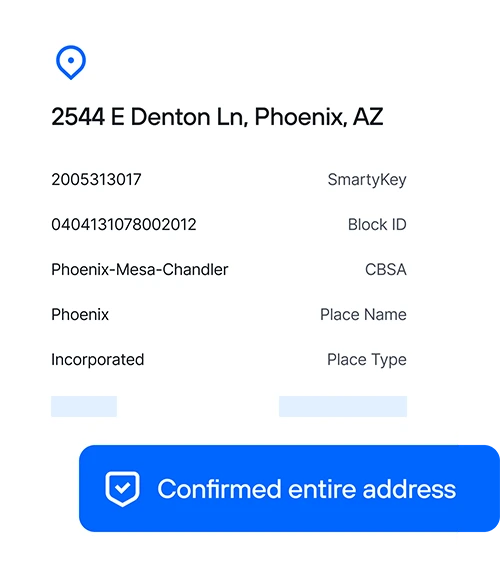

Blend diverse data with SmartyKey®

Manage alias locations, public data records, identify duplicative info, and merge property data with Smarty’s unique identifier, SmartyKey.

Our results

Get industry-leading accuracy

+

points of property characteristics

B

Addresses processed all in a day's work

M+

US addresses available

Stars

based on G2 reviews

How it works

US Property Data enhances property data reports in four steps

Step 1

Verify

Identifies, verifies, and standardizes the input address.

Step 2

Geocode

Finds the precise coordinates of the structure at the property address.

Step 3

SmartyKey

Finds the assigned SmartyKey–a persistent unique identifier (PUID)

Step 4

Enrich

Uses SmartyKey to connect property data to the address.

What property data does Smarty provide?

60+ Property location attributes

Precise geographic property characteristics are vital to creating property profiles for investing and risk management. Property location attributes include structure elevation, county, city, and mailing address topography so you can make better strategic business decisions.

150+ Property structure attributes

Use this dataset to take the guesswork out of assessing a building's structural components and create accurate property descriptions. Structural data points include square footage, roof material & type, and construction type.

130+ Financial data points

Simplify the way your business gathers financial data on properties. Financial data points can help you get an accurate assessment of a property. Smarty's financial data includes the property's total market value, assessed value, tax data, prior sale amount, and other financial information to enhance your business decisions.

How you win with US Property Data

Unlock a Gringotts vault of property data gold among every property address using Smarty's address enrichment API.

Address data enrichment

Access the hundreds of public data records of property data USA aggregated into a single property data API and more than 210M location addresses; accurately enriching your data has never been easier.

Parcel data

Use the US Address Enrichment API to append property public records to an address's parcel data for addresses already in your database.

Property feature data

Take advantage of a property data service that can give you mortgage loan value, square footage, sale price, and hundreds of other public record data points.

Real estate data

Build a more complete profile of commercial and residential properties with recent and historical tax assessor data, average price, and more.

Property data USA API solutions

Delight your development team with our easy-to-implement and lightning-fast US address enrichment API packed with property feature data.

Persistent unique identifier (PUID)

Blend first- and third-party data with SmartyKey®. SmartyKey identifies an address throughout its existence, even if the address elements change.

Who benefits from US Property Data?

Property and Casualty Insurance Companies

Property data enrichment is crucial for accurate underwriting and Department of Insurance compliance. Insurance companies can confidently bind new policies while improving loss ratios. Plus, access crucial public records including land ownership, square footage, and parcel boundaries.

Real Estate

Using address enrichment to enhance real estate data is simple with property data. Get access to crucial structure, location, and financial data for more informed investment decisions. With property data at your fingertips, you'll have access to information for residential and commercial properties, including appraised value, parcel boundaries, total market value, tax details, and much more.

Banks and Lending

Property records data improves banking and lending by enabling precise risk assessment, underwriting, fraud prevention, and streamlined portfolio management. It offers real-time market insights, ensures optimal pricing, aids regulatory compliance, speeds up customer applications, and informs investment advice.

Retail Companies

Real property can pose a difficult hurdle for growing retail companies. Smarty's US Property Data assists in identifying top-performing locations. Retail companies can select the best sites for their company by utilizing our property record data, including area tax information, market value, parcel boundaries, and assessed value.

Slick property data API implementation

Superior property records accuracy

Remedy your frustration with missing and inaccurate property records. The US address enrichment API comes with access to SmartKey, a persistent unique identifier assigned to every address in the United States. Using SmartyKey means you get the most accurate data regardless of how frequently property boundaries and addresses change.

Easy-to-follow documentation

Some APIs are a lot like fighting a balrog—dreadful. Smarty's US address enrichment API isn't one of those. Software engineers love the simplicity of Smarty's documentation built by developers for developers to help them smite the foe complexity on the peak of Zirakzigil. Overall, Smarty helps you skip the implementation hassle of the mines of Moria and access our database of property characteristics faster.

Beyond compare, expert, free-of-charge support

Skip the phone tree and talk directly to Smarty's US-based support team. You may never need to speak with our legendary support team, but if you do, you'll love the warmth of talking to an actual human that can solve your issues right away.

Flexible plans to match your business needs

Select a US Property Data plan that makes the most sense for your business. Smarty's main plan includes 350+ data points, but maybe you only need 5–50 property data points from all the property public records in its database. We can customize a plan to fit your needs.

Simple address enrichment API

Smarty makes it easy to implement our API. We've packed our site with SDKs and other clear documentation for the most straightforward integration you've ever experienced. Our legendary support team can help if you ever find yourself in a tight spot.123

result = client.send_property_principal_lookup("your_smartykey_here")

print(result[0])

print(result[0])

How others are using Smarty

Rooftop geocodes for accurate fire and weather risk modeling

Hippo can accurately predict future risks and understand its exposure while getting better pricing on reinsurance.

Rooftop geocoding for insurance risk analytics

This P&C insurance provider utilizes property profiles and property line maps to analyze high-risk areas with exactness and provide the right coverage for property owners.

FAQ

How often is Smarty US Property Data updated?

Property characteristics change often. These include changes such as street names and building renovations. To provide our customers with the most recent property data, we push updates to US Property Data monthly.

What does parcel data mean?

Parcel data is a series of property attributes assigned to a commercial or residential boundary. With public records including document images, parcel data can include:

- Locational features:

- Structure elevation

- Subdivision

- Zoning

- Structural features:

- Construction

- Roof type

- Square footage

- Financial features:

- Loan to value

- Recent sale amount

- Assessed value

Why is it called a parcel of land?

The word "parcel" originated from an Old French word "parcelle," which means a small piece or portion. So, a "parcel of land" simply denotes a portion or piece of land. The term parcel is most often used in the real estate industry and in legal descriptions describing the boundaries of land to be sold or referenced in sales and legal proceedings.

How do I purchase Smarty US Property Data?

Smarty's US Property Data is scalable to your business. If you're just starting, we have subscriptions you can purchase online for up to 15,000 lookups. If you're looking for more extensive or custom plans, our property data experts can help you build a custom plan from 50,000 to 5,000,000 lookups.

What if a property doesn't have a lot of data?

Smarty strives to provide as much data as possible on each property. However, in some cases, our sources provide minimal data on specific properties. We're constantly updating and improving our data sources. Properties with limited data now may return more data in future monthly updates.

Can I buy US Property Data by county or state?

No. Smarty's US Property Data is only available on per-lookup subscriptions. Plans start with as few as 5,000 lookups but can be purchased up to 250,000,000 lookups. Discover the right plan for your business by visiting our pricing page.

What is property data USA?

Property data USA is an aggregation of public property records on most properties in the United States. Property data USA looks at property from the parcel level. By taking a broader view, property characteristics including public records on the location, structure, and financial can be aggregated for a holistic view of the property. While the parcel view is great for characteristics, it's also important to geocode the property's primary structure for maximum precision. This is why Smarty combines each plan with property data USA data with rooftop-accurate geocodes.

More FAQs

Select a category to see more information about a certain topic.

US Property Data pricing

Selecting the right property data plan for your business is easy. Want to give it a test drive? Hit the accelerator on a free trial. Ready for something with more horsepower et all 350+ property attributes or choose the 5–50 you need most.Free trial

Starting at

1,000

lookups

350+ property attributes

350+ property attributes No credit card required

No credit card requiredProfessional

$350

per yearTerm

Address Lookups per year

Popular

Most Popular

350+ attributes (structural, locational, financial)

350+ attributes (structural, locational, financial)Custom

Customize to your company's exact needs

Choose your features Custom lookups / year

Custom lookups / year Custom legal terms

Custom legal terms Enhanced data privacy

Enhanced data privacy Enhanced data compliance

Enhanced data compliance

Custom lookups / year

Custom lookups / year Custom legal terms

Custom legal terms Enhanced data privacy

Enhanced data privacy Enhanced data compliance

Enhanced data compliance