Location intelligence for insurance solutions

Location intelligence for insurance solutions equates to real-time insights that enable underwriters, adjusters, risk management teams, and other insurance professionals to make informed decisions with confidence. By leveraging geospatial data and analysis, insurers can better assess risks, personalize policies, and improve customer service.

Inaccurate address data has long been a frustration for insurance professionals and processes. To take hold of the valuable insights provided by location intelligence, you’ll need top-notch rooftop geocodes and property data points. Our APIs are here to jumpstart your address data journey. Location intelligence for insurance solutions is right here, free for you to test out.

Before we get started, here's what we're going to cover:

- Location intelligence explained

- How location intelligence revolutionizes insurance

- Key benefits of location intelligence in insurance

- Location intelligence for risk assessment and policy pricing

- Strategic uses of location intelligence

- Technological components of location intelligence

- Conclusion

Location intelligence explained

Location intelligence is the understanding gained from geospatial data after it has been visualized and analyzed. For insurance organizations, location intelligence helps everyone from underwriters to claims managers understand geospatial data points by revealing patterns, trends, and relationships within a dataset in real time.

Here’s an example of location intelligence in action. An insurance company is pricing a policy for a McDonald’s located near a cliffside and a body of water. Using location intelligence—which includes data on flood risks, structure elevation, and extreme weather events—the insurer assesses risk and determines a fair premium (and we keep ordering late-night burgers. 😉)

What is location intelligence

Location intelligence plays a crucial role in insurance operations for insurance professionals. With it, risk management teams can develop programs that pinpoint structures within risk zones, underwriters can assign premiums with rooftop-level accuracy, and claim managers can improve their claims reporting.

Location intelligence for insurance solutions play a role in identifying and reducing fraud. By comparing the claimed damages to location data, one insurance company saw their direct losses decrease by 57% over just five years.

Armed with advanced data analytics, insurance professionals can do what they do best as they draw insights from geospatial data. It isn’t as heavy a lift to do their jobs either, because with tools that run seamlessly in the background, commercial property risks become immediately clearer.

The role of geospatial data

Geospatial data is the foundation for location intelligence for insurance solutions. While it might not be great at identifying loss propensity due to a commercial property’s inability to keep their world-famous shakes stocked, geospatial data can assist with loss propensity projections because the roof may cave in any second.

Need a refresher on the top geospatial data points for the insurance industry? Here are a few spatial analysis points that are built into our location intelligence API:

- Structure attributes. Geospatial data can provide insurers with a residential or commercial property’s construction material, roof condition grades, square footage, and much more.

- Location characteristics. Location-specific data, such as a property’s elevation, tax jurisdiction, and subdivision, gives insurance professionals an accurate picture of insured properties.

- Financial information. Geospatial data isn’t limited to the physical attributes of a property. It also covers a property's market value, assessed value, and prior sale amount.

- Census data. Insurers can also inform their decisions with the census block, block group, and census tract associated with an insured property.

How location intelligence revolutionizes insurance

Uninformed decisions, slow claims processing, interrupted billing operations, inefficient checkout processes, and a lack of real-time insights can have extensive costs for insurance organizations. The hero coming to resolve these issues? Location intelligence data.

Enhancing decision-making processes

To up their decision-making game, underwriters need accurate address data. That’s what geocoding provides.

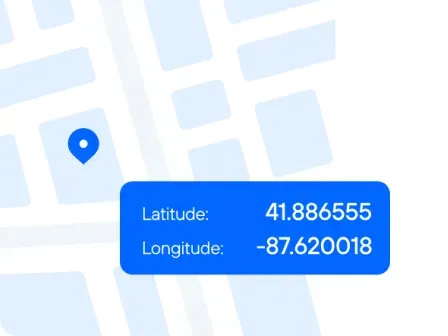

With coordinates that identify the primary structure's rooftop, underwriters can utilize insurance location intelligence to calculate the exact distance between an insured property and geographic risk factors like wildfires, bodies of water, and high-crime areas.

Rooftop-level geocodes will also enable underwriters to confidently decide if a property is within high-risk areas, such as a flood zone or a region with a history of extreme weather events.

In addition to pinpointing exact coordinates, geocoding pinpoints secondary address information, which includes secondary designators (e.g., Apt, Ste, Bldg, Unit, etc.) and secondary numbers (e.g., Apt 102, Ste 101, Bldg E-5, Unit 4, etc.)

Smarty’s US Secondary Address Data provides this location data, as well as the number of units at a primary address. With secondary address information for every unit within a building, insurance professionals can better understand an insured property, which empowers investment decisions.

With these valuable insights, decisions about insurance policies will become more accurate, preventing outrageous loss ratios from cutting into earnings and giving customers accurately priced premiums. (Insert victory dance here! 🕺)

Real-time mapping and diverse data sources

Sending an adjuster to an insured property costs insurance businesses time and money and causes a delay in collecting, assessing, and mapping data.

Location intelligence gained from geocodes and property data limits this latency. With Smarty’s US Property Data, insurance companies can access 350+ data characteristics for over 210 million US addresses.

With this diverse, real-time data, insurance professionals can quickly analyze risk, then return quotes to their customers without a frustrating delay. Talk about ROI! 🎉

Streamlining operations and processes

Insurance companies send documents—premium invoices, payment reminders, renewal notices, and non-renewal notices—to policyholders. Bad insurance location intelligence that causes insurance documents to arrive late, or not at all, is like a banana peel on the racetrack, causing the painful spinout of policy creation and claims processing.

With Smarty’s US Address Autocomplete, inaccurate location intelligence is prevented from entering a database long before it becomes an issue.

When customers use autocomplete to provide a validated address during quoting, they can only select verified addresses, which ensures that a policyholder’s address is deliverable.

This means that documents reach policyholders the first time they’re sent. When these documents don’t need to be redelivered, insurance companies cut costs and prevent lost or misdelivered mail from putting the brakes on claims processing.

Additionally, claims management becomes smoother because the data needed to double-check those claims is at the claims agent’s fingertips. Operational efficiency is at an all-time high, and of course, that trickles down to customer satisfaction as well. A quickly resolved claim is key to customer satisfaction.

Boosting conversions on online apps and checkout systems

The benefits of address autocomplete don’t end there, especially for insurance companies that utilize mobile or web forms in their checkout process.

When users fill out a form, they expect a lightning-fast experience. If checkout takes longer than anticipated, they’ll likely abandon ship. According to Hotjar, 70% of users leave their forms unfinished when they’re unsatisfied with their experience.

Reducing checkout time is key to avoiding this friction. Enter autocomplete. While manual address entry can take up to 40 keystrokes, autocomplete allows users to enter their address in 2–3. After just 1 keystroke, autocomplete begins suggesting addresses, with local addresses—based on the user’s IP address—populating first.

With this faster checkout process, users are less likely to abandon web forms and more likely to complete the checkout process. You’ll be able to watch your conversion rates rise—and your stress levels drop. 🙌

Address data quality also improves when the address is integrated into the checkout process.

When asked to manually enter their address, users often forget their secondary address information, such as their apartment or suite number. Inaccurate addresses at checkout can lead to errors that prevent conversions down the line.

Using both USPS and non-USPS addresses, autocomplete suggests addresses that include secondary designators and numbers. After a user selects their address from the options provided, the address will be parsed automatically. While users will love their effortless checkout experience, your address data will stay squeaky clean.

If you’re looking to boost your conversion rates and enhance your online apps and checkout systems, it’s time to add address autocomplete to your company’s toolbelt.

Key benefits of location intelligence in insurance

There are several reasons to invest in location intelligence for insurance professionals. We’ll go over the three top benefits of having location intelligence for insurance sales agents and underwriters that’s so good, it could sell flood insurance to a camel. 🤣

Amplifying sales agent productivity

Insurance sales agents boost productivity by acquiring new customers. The location intelligence provided by address autocomplete was born to do just that.

Address autocomplete tools ensure that customers provide valid addresses during onboarding, meaning incorrect data can’t block them from submitting applications. Autocomplete also decreases the time applicants spend on applications, meaning more finished forms and more approved policyholders.

Simplifying claims processing

Location intelligence for insurance underwriters enables straight-through processing of claims. With reliable, accurate data, underwriters can make automatic decisions on low-risk applications, rather than manually verify the location of applicants’ properties.

Real-time location intelligence for insurance underwriters also streamlines high-risk applications. With Smarty’s cloud-based US Rooftop Geocoding, addresses can be batch geocoded at ludicrous speeds, meaning underwriters can avoid unnecessary delays.

Empowering underwriter teams

We’ve made a checklist you can use to make sure your location intelligence is helping your underwriters make informed risk management decisions with mindblowing confidence. If you’re not checking all the boxes, it might be time for an upgrade.

With the best geospatial and location intelligence for insurance companies, underwriters can:

- ✅ Pinpoint the exact location of a property.

- ✅ Calculate the distance between a location and a risk factor.

- ✅ Determine if a location is within a risk zone.

- ✅ Ensure a policy’s pricing is accurate.

- ✅ Gain valuable insights from property intelligence.

- ✅ Quicken the claims process.

Location intelligence for risk assessment and policy pricing

To correctly price policies, insurance businesses need to be experts in risk analysis, which means they need top-notch geospatial and location intelligence. With property data provided by geocoding, best-in-class data quality is within reach. 👏

Accurate risk assessments

With rooftop-accurate geocodes and the enrichment data that comes with them, insurance companies can make incredibly accurate risk models.

While geocodes can be used to determine if a property is in high-risk areas with histories of severe weather patterns or in a zone with known flood risks, enriched data gives insurers a more accurate picture of a property. With real-time information about elevation, previous ownership, and construction material, risk assessments become more accurate.

Improved policy pricing strategies

The power of geocoding doesn’t end there. Accurate rooftop geocodes can differentiate between two units in a multi-unit building, allowing insurers to correctly price each unit. This is especially important for large complexes where two units could have completely different geographic risk factors.

Ensuring fair and bias-free pricing

To fairly insure an irregular parcel—let’s say, a blobfish-shaped piece of land squeezed between a mall and a hard place—insurers need to have the exact coordinates for a structure, rather than ones that are placed in the middle of a parcel.

As with multi-unit buildings, geocodes can identify the primary structure on an irregular parcel, so insurance companies can correctly price their premiums for their policyholders, no matter how much their property’s lot resembles a blobfish.

Strategic uses of location intelligence

While the location intelligence insurance providers use can improve policy pricing and risk assessment today, it also helps down the road. Here are a couple of ways how.

Investment planning

Hippo, a property insurance company, needed accurate data for their risk models. Without it, the future risk of the area could be miscalculated, leading to mispriced insurance policies.

Utilizing Smarty's US Rooftop Geocoding and US Address Verification, Hippo now predicts future property risk exposure before reinsurance and provides customers with quotes before a development’s construction is complete.

With the help of valuable location intelligence data, future risk analysis becomes more accurate (and boosts ROI! 🥳)

Disaster preparedness

To prepare for natural disasters and climate change, the insurance industry utilizes early warning systems to predict potential risk exposures, but these systems are only as good as the geospatial data they use.

With real-time data provided by location intelligence and rooftop-level geocoding, early warning systems can predict which insured properties are at risk of a disaster and better model solutions for weather, fire, seismic, and flood risks.

Route optimization

After a natural disaster has occurred, adjusters can put US Reverse Geocoding to work. With it, they’ll be able to find the exact location of a property, even if the identifiers typically used to locate it have been destroyed.

They’ll then be able to utilize Geographic Information Systems (GIS)—software systems that store, manage, analyze, and visualize geospatial information—to route adjusters to the property for prompt damage inspections.

Technological components of location intelligence

As we’ve covered the many ways insurers can use location intelligence, it’s become pretty clear that geocoding is at the heart of what location intelligence does best—open the door to innovative solutions.

Geocoding and its importance

We could deliver a Shakespearean monologue on geocoding, but we’ll give you the CliffsNotes instead. With geocodes, insurance professionals can:

- Boost data accuracy with rooftop-level coordinates

- Calculate distances between insured properties and potential risks

- Determine whether a structure falls within a risk zone

- Avoid the latency of in-person inspections

- Batch geocode large amounts of addresses in record time

- Improve underwriting accuracy and risk modelling

- Increase preparedness for natural disasters

- Level up their awesomeness 💪

Looking for a more comprehensive overview of geocoding? Check out our guide!

Conclusion

From upgrading risk analyses to improving policy pricing, location intelligence for insurance solutions is innovative and ready to be implemented. With address data tools like geocoding and address autocomplete, these solutions are up for grabs.

If you’re ready to empower your employees and enhance your processes, sign up for a free trial today. We’re pretty confident you’re going to love it.