Empowering finance, healthcare & insurance companies with international autocomplete

Address data plays a vital role for finance, healthcare, and insurance companies. When these companies serve customers worldwide, processes like KYC compliance, fraud prevention, and onboarding become even more complicated, making accurate data even more essential.

Enter International Address Autocomplete, a form and checkout address-filling feature that saves the day for more than just ecommerce companies based in the US. It’s also great for finance, healthcare, and insurance companies worldwide.

To learn more about how a global autocomplete solution can be the address data hero you need, read on. 🦸

| International Address Verification | International Address Autocomplete | International Geocoding |

|---|---|---|

| Try it now | Try it now | Try it now |

Suit up. We’re about to cover:

- It’s not a bird or a plane, it’s international autocomplete

- How global autocomplete comes to the rescue

- Does your address autocomplete deserve hero status?

It’s not a bird or a plane; it’s international autocomplete

When a user types, international autocomplete automatically suggests real, verified addresses for any country. This automation reduces the time it takes to complete a form while simultaneously preventing invalid addresses from entering your database. Talk about heroic! 💪

With great power comes great subunit support

Another superpower that Smarty’s international autocomplete offers is the ability to suggest secondary unit designators, such as apartment, unit, building, or suite number, as users input their addresses.

These secondary addresses are especially important for companies with customers in countries where high address density is common, such as Australia and the United Kingdom. Without these unit numbers, data quality drops. With complete addresses, you can boost the accuracy and efficiency of processes like quoting, delivery, compliance, and fraud detection.

All languages? We could do this all day

Currently, there are 7159 languages spoken throughout the world and 294 writing systems, meaning an address can be written in hundreds of different alphabets.

That’s why international autocomplete comes with a world-class sidekick: address transliteration. This feature accurately converts the characters of an address from one alphabet to another. Let’s break this down with an example.

A user enters the Canadian address 2795 Rue École Beresford, NB E8K 1V4 into a form equipped with international autocomplete. As the address enters a database, address transliteration jumps in and changes the ‘É’ in École to ‘E.’

This is because ‘É’ isn’t a recognizable ASCII character—a character used to encode electronic communication. By changing the É to an E, transliteration prevents errors in any address sorting, organizing, tracking, verification, and standardization done by a computer.

It’s important to note that transliteration isn’t translation. A translated version of our example address would replace ‘Rue École’ with ‘School Street.’ Transliteration only replaced ‘É’ with a computer-compatible character, keeping the rest of the address in its original form.

For companies with global customers or those in multilingual countries like Canada, address transliteration allows customers to provide their address in whichever language they speak without compromising data quality. With top-notch data, companies can analyze, report, and strategize with confidence.

How global autocomplete comes to the rescue

There are even more ways international autocomplete can change the game for healthcare, insurance, and finance companies located outside the US. Let’s dive right in.

Finance

International autocomplete gives financial institutions the ability to unlock better efficiency and security through accurate address data. Considering that global fraud losses hit $485.6 billion in 2023, every safeguard against bad data makes an impact.

From preventing fraud to limiting billing errors to streamlining operations, autocomplete does it all.

When customers apply for loans, debit cards, or credit cards, a slow onboarding experience can lead to an incomplete application, or worse, an abandoned one. In fact, 67% of banks report losing clients due to clunky KYC processes. International autocomplete gives applicants the speed they need—no matter where they live.

Plus, since synthetic profiles can’t link to invalid addresses, international autocomplete helps to prevent fraudulent addresses from entering a database. With validated data, you’ll also keep up with the ever-evolving KYC and AML compliance and regulations. With global compliance costs reaching $274 billion annually, this will give you a competitive edge.

For finance companies that send cards, bills, statements, or other communications to customers across the globe, international autocomplete ensures that time and resources don’t go to waste tracking down and redelivering failed shipments.

MAJORITY, a digital financial services company, found that address autocomplete was the hero they needed to improve the UX of their app, reduce undeliverable cards by 50-70%, and keep their data KYC compliant. 👏

Healthcare

Healthcare companies worldwide prioritize regulatory compliance, but when clients are spread across national borders, noncompliance only increases.

Each country enforces its own data laws, like GDPR in the EU, PIPEDA in Canada, and the APPs in Australia. Each requires accurate and secure personally identifiable information (PII).

International autocomplete minimizes compliance violations and protects client information by preventing invalid addresses from entering a database. With a verified address for every client, you can confidently ship prescriptions, medical supplies, or bills to the people who need them.

With built-in privacy for PII, you can rest well knowing that your database is free of fraudulent data and compliant with regulations protecting health information, such as PIPEDA, GDPR, and the APPs.

That trust translates into real business impact. For 81% of consumers, ethical data handling is a key factor in whether they feel valued by a company.

Additionally, good address data streamlines international claims processing. Incorrect addresses can lead to payment delays and denials, as well as long customer service calls. Autocomplete will keep your processes running smoothly, and your customer service reps providing help to the people who really need it.

Plus, the stakes are even higher. Annually, healthcare supply chain inefficiencies cost organizations over $12 million, even though operating margins average just 0.8%. Investing in better data infrastructure—such as automated verification tools—can cut supply chain process costs in half and deliver a 124% ROI in a single year.

When international autocomplete teams up with global address verification and geocoding, it offers healthcare companies even more benefits.

Beyond smoother compliance and claims handling, reliable address systems protect healthcare companies from costly shortages, which can add $3.5 million in care costs, $350K in lost revenue, and another $1 million in excess inventory for a mid-sized provider. That adds up to $4,850,000 in losses. 😱

When you factor in supply chain inefficiencies, the average annual loss a mid-market healthcare company faces from bad address data jumps to $16,850,000.

Address precision is more than a convenience. It’s a competitive edge that can help healthcare companies save millions. Looking to learn more? Here’s what Smarty’s suite of address validation tools brings to the table.

Insurance

Speed is crucial for customer onboarding, quotes, and renewals. When a quick application process leads to a frictionless and accurate quote, customers are more likely to renew.

Who’s the villain standing in the way? Bad international address data.

Without the best data around, insurance companies face several issues that stem from inaccurate address data, including:

- Incorrect coverage rates: Incorrect or incomplete addresses can lead to mispriced policies, expensive legal battles, additional customer service hours, and reputation damage. Poor data quality drives “less-than-optimal decisions” and increases insurers' compliance risks.

- Delayed quoting or onboarding: If an inaccurate address is entered during onboarding, it can require manual verification and correction by underwriters, leading to quote friction and customer drop-off.

- Exposure to compliance risk: When global addresses don't include secondary designators, quote accuracy drops, which can void policies and accrue costly fines. 😬 There’s good news, though. Address verification platforms have reduced fraud-related losses by more than half and achieved 97.5% match accuracy across hundreds of jurisdictions.

Don’t let bad address data defeat you. International autocomplete ensures addresses are verified and compliant from the first letter an applicant types. Plus, it’ll operate at speeds fast enough to keep up with the Flash.

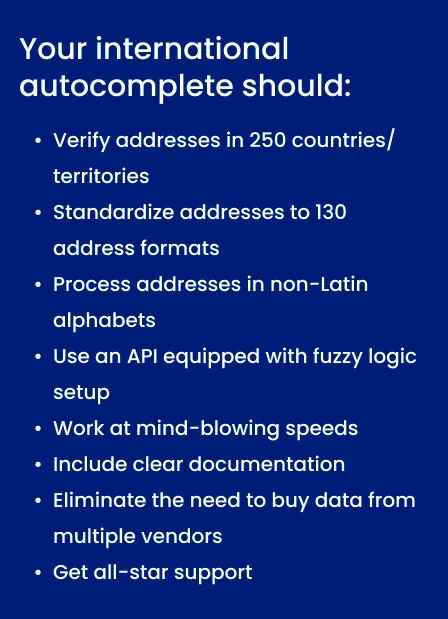

Does your address autocomplete deserve hero status?

Sure, a local vendor may have the address data you need for one country, but companies with global customers need a comprehensive solution that works for any customer, anywhere in the world.

If you have international customers, your autocomplete solution should support your home country and everywhere else. Don’t settle for less.

To see autocomplete optimize your forms for a global audience in real time, give Smarty’s International Autocomplete a free, 42-day test drive. Or, talk to a real person who’s ready to answer any question that begins or ends with autocomplete.